Limited Time Special: HELOC 2.99% APR* Introductory Rate

Take Advantage of One of the Best HELOC Rates in Connecticut!

Already a Member? Click here to stop seeing this message.

Wherever You Are

Bank From Your Phone With The Finex Credit Union App

Manage your Finex Credit Union accounts and enjoy advanced features that help you keep your finances on track from the palm of your hand!

-

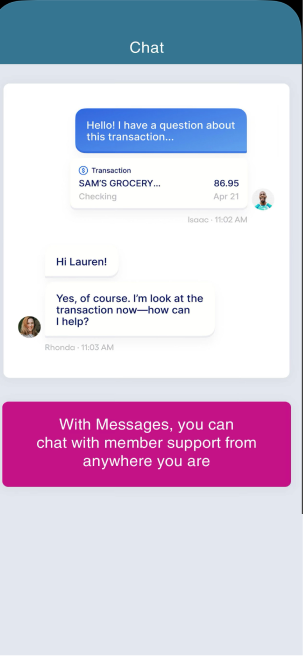

Chat With Us

Chat with our member support team in real-time through the Finex Mobile Banking App. It's safe, secure, and available for you wherever you are!

-

Send Money with Zelle®

Explore Zelle®Pay back your friends or cover your portion of the bill quickly and securely with just an email address or U.S. mobile number.

Articles

6 Family Travel Tips that will Save You Money and Headaches

The importance of getting the best possible value for your vacation budget cannot be understated. But it’s just as important to balance money-saving strategies with peace of mind. Explore these "family travel tips" that will help you and your family save money and avoid potential headaches.

Articles

Here’s Why Budgeting in Your 20s is Important and How to Get Started Today!

Making smart money moves when you are just starting out in life can make all the difference in the success of your financial future. A few smart choices and strategic cutbacks in your 20s may actually help you have the means to have an even better quality of life in the future

Calculators

Calculator: Loan Payment Calculator

Budget for your financial future with our Loan Payment Calculator. Discover a payment that fits your budget.

Calculators

Calculator: How Much Will My Certificate Be Worth at Maturity?

Are you currently investing in a certificate account? Discover what the value of your investments will be upon maturity.

Calculators

Calculator: Should I Lease or Purchase a Car?

Our Lease vs Buy Calculator, or Car Lease Calculator, will help you determine how much car you can afford in CT and your potential car loan payment.

Calculators

Calculator: How Much Will My Auto Payments Be?

Are you searching for a Car Payment Calculator in CT that can help you determine how much car you can afford? Finex Credit Union's Auto Loan Calculator is designed to meet your needs.

Calculators

Calculator: How Much Car Can I Afford?

Use this auto loan calculator to determine your budget. If you're wondering, "how much car can I afford?", our car affordability calculator has you covered.

Calculators

Calculator: Mortgage Payment Calculator

Our Mortgage Calculator can help you calculate a mortgage payment that will work for your Connecticut home. Calculate the payment that fits your budget today.

Calculators

Calculator: How Much Home Can I Afford?

If you're looking for a house, knowing how much you can afford is step 1. Discover how much house you can really afford with our mortgage calculator.

Calculators

Calculator: Should I Refinance My Home?

Our Mortgage Refinance Calculator can help you determine if refinancing your home loan is right for you. See if refinancing your Connecticut mortgage could save you money on your mortgage payment.

Calculators

Calculator: How Long Until I Reach My Savings Goal?

Trying to reach a savings goal? Use our Savings Goal Calculator to determine when you can expect to reach your goal!

Calculators

Calculator: How Much Should I Save For College?

It's never too early to start saving for college! Use our College Savings Calculator to determine how much money you need to be setting aside for school.

Calculators

Calculator: How Long Will It Take To Pay Off My Credit Cards?

Determine how much you should be paying toward your debt and when you can expect to pay off your credit cards.

Calculators

Calculator: How Long Will It Take to Pay Off My Loan?

Determine how much you should be paying toward your debt and when you can expect to pay off your loan.

Calculators

Calculator: Should I Consolidate My Debts?

Our Debt Consolidation Calculator can help you determine if debt consolidation can save you money.

Calculators

Calculator: How Will Extra Payments Affect My Loan?

Making extra loan payments could help you pay down your loan faster and save you money.

eBooks + Checklists

Roadmap to Building Credit: Second Chance Checking and Specific Steps to Rebuilding Credit

Sometimes things just do not work out as we planned when it comes to money and finances. Explore our Roadmap to Building Credit to get your finances back on track!

eBooks + Checklists

How Much House Can I Afford in Connecticut?

The process of determining how much house you can afford and qualifying for a mortgage in Connecticut can feel challenging. Explore our guide to answer the question, “How much house can I afford?”

Articles

Budgeting in Uncertain Times: 11 Ways to Save Every Day

Making a personal budget not only helps people save but can also help them achieve financial stability. Knowing how much money is needed to cover expenses can help prevent overspending. It can also identify places to reduce spending, allowing for more savings to take place.

Articles

Avoiding Online Financial Scams in the Digital Age [Top 7 Safety Tips]

We hear the occasional news about hackers stealing millions from large corporations, but hackers target community members more frequently. The following social media fraud statistics demonstrate that digital thieves continue to successfully scam people.

Articles

Take Advantage of Memorial Day Car Sales With These Tips

Memorial Day weekend remains an optimal time to buy a car, truck, or SUV, at a reduced cost. Take advantage of these tips to save money and walk away with a vehicle, and car loan, that works for you and your budget.

Articles

First Job? Here's How to Set Your Finances up for Life

Landing that first job means having a regular influx of cash, but steady work alone doesn't guarantee financial health. Here's how to build the foundation for lifetime financial security.

No results found.

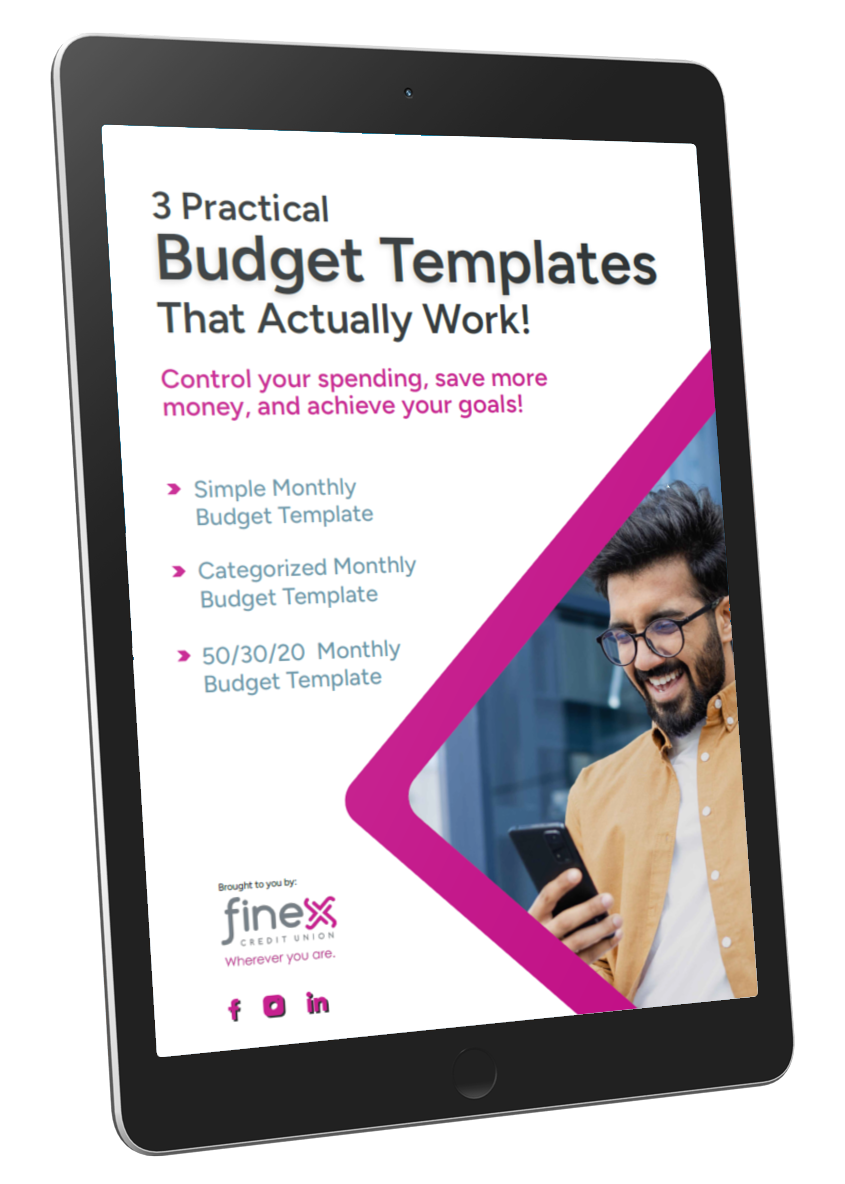

Download Your Free Templates

Budgeting Templates That Actually Work!

Our financial experts have created these easy to use budgeting templates to help you achieve your financial goals. Download and get saving!

Join The Best Credit Union In CT

"I'm very happy I joined Finex credit union. It was an awesome experience and very easy for me to navigate online with the support of Staff responding in a timely manner. I would like to give a special Thank You! to Josephine Gonzalez who assist me during the processing phase of my loan application she is a star. 🌟"

Regina P.

"One of the best banking institutions I have ever been to. The staff is extremely friendly and professional, especially Cameron. They are attentive to your needs and help with any questions you may have. If could give them more than a five star I would!"

Adrianna S.

"Nancy from Finex has always been a pleasure to work with. Very professional, is helpful and understanding. Always reaches out if she has questions and always answers my questions. She exceeded my expectations as a customer and is honestly the reason I continue to stay and enjoy banking with Finex!"

Shawn M.

*APR = Annual Percentage Rate. The displayed APR represents the lowest possible rates available. Rates are based on credit score, term, and membership status and are subject to change without notice.